Investments

Investments should be the main reason to spend money, because it generates back a multiple of the spent amount.

Investing allows individuals to potentially earn returns that exceed inflation, helping to build wealth over time. investing can also help individuals meet long-term financial goals such as saving for retirement or funding a child’s education.

Overall, investing is an important tool for individuals to build wealth, achieve financial goals, and prepare for the future. However, it is important to approach investing with a disciplined and rational mindset, and to seek out professional advice if necessary. I will discuss different ways to invest your money, and how to do it in a guaranteed profitable way.

Stocks

A stock, or a share, represents a unit of ownership in a publicly-traded company. When a company goes public and issues stocks, it is essentially selling ownership in the company to investors. As a shareholder, an individual has a claim on a portion of the company’s assets and earnings, as well as the right to vote on important company decisions.

Stocks are traded on stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ, where investors can buy and sell shares of publicly-traded companies. The price of a stock is determined by supply and demand, and is influenced by a variety of factors such as the company’s financial performance, industry trends, and overall market conditions.

Investing in stocks can potentially offer higher returns than other asset classes such as bonds or savings accounts, but also comes with higher risk. It is important for investors to conduct thorough research and analysis before investing in stocks, and to diversify their portfolio to manage risk.

Stock screener

A stock screener is a tool or software that allows investors to filter and narrow down a large universe of stocks based on specific criteria. With a stock screener, investors can set various parameters to identify stocks that meet their investment objectives and requirements. Some of the criterias I like to set for my stocks are:

- A current ratio above 1.5.

- Total debt to equity ratio below 0.5.

- Price to earnings ratio (PE) below 15.

- Return on equity (ROE) above 15.

Annual report

An annual report is a comprehensive report published by a company on a yearly basis that provides an overview of its performance, financial position, and operations over the past year. The report is typically aimed at shareholders, potential investors, and other interested parties, and is a key source of information for assessing the company’s performance and prospects.

An annual report typically includes a variety of information, including:

Financial statements: These include the balance sheet, income statement, and cash flow statement, which provide a detailed breakdown of the company’s financial position and performance.

Management’s discussion and analysis (MD&A): This section provides management’s perspective on the company’s financial performance over the past year, as well as an analysis of the factors that have influenced the company’s results.

Corporate governance: This section describes the company’s governance structure, including the roles and responsibilities of the board of directors and senior management.

Business overview: This section provides an overview of the company’s business operations, including its products and services, markets, and competitive landscape.

Corporate social responsibility (CSR) and sustainability: Many companies include information on their CSR and sustainability initiatives, including environmental, social, and governance (ESG) performance metrics.

Overall, the annual report is an important source of information for investors and other stakeholders, and provides a detailed picture of a company’s financial health, operations, and strategic direction.

Intrinsic value

The intrinsic value of a stock refers to the true, inherent value of the company that the stock represents. It is the actual value of a company, taking into account factors such as its assets, liabilities, earnings, growth potential, and overall financial health.

Intrinsic value is often used by investors to determine whether a stock is undervalued or overvalued in the market. If the market price of a stock is below its intrinsic value, it may be considered a good buy, as the stock is undervalued and has potential for growth. Conversely, if the market price of a stock is above its intrinsic value, it may be overvalued and potentially subject to a price correction in the future.

Calculating the intrinsic value of a stock can be complex and involves analyzing various financial metrics, such as cash flow, earnings, and book value, as well as considering external factors such as industry trends and economic conditions. There are various methods for determining intrinsic value, including discounted cash flow analysis, price-to-earnings ratio analysis, and price-to-book value analysis.

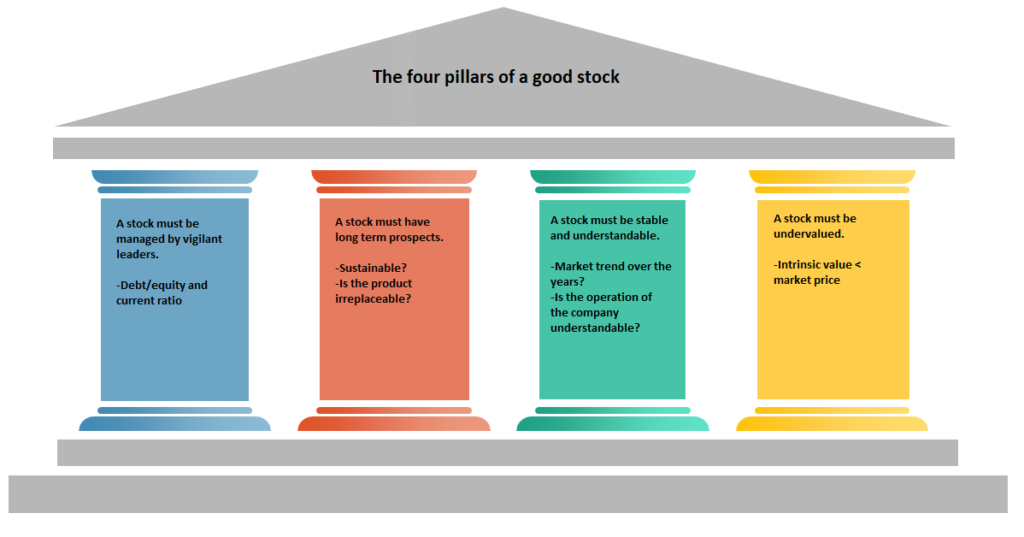

The four pillars of a good stock

Warren Buffet invented the term “the four pillars of a good stock”, which consists of four criterias to be passed in order for a stock to be worth buying. The four pillars are as follows:

1. A stock must be managed by vigilant leaders. Vigilant leaders are individuals who possess a strong awareness of their surroundings, an acute attention to detail, and a proactive mindset when it comes to addressing potential risks and challenges. They are always alert, observant, and responsive to changes in their environment, and are able to make quick and effective decisions to mitigate risks or seize opportunities.

Some key traits of vigilant leaders include:

Situational awareness: Vigilant leaders have a deep understanding of their environment, including potential risks and challenges, as well as opportunities for growth and improvement.

Proactivity: Vigilant leaders are proactive in their approach to leadership, constantly seeking out new ways to improve their organization and address potential issues before they become major problems.

Strong decision-making skills: Vigilant leaders are able to make quick, informed decisions based on their understanding of the situation and their organization’s goals and objectives.

Effective communication: Vigilant leaders are able to communicate effectively with their team and other stakeholders, sharing their vision, priorities, and concerns in a clear and concise manner.

Resilience: Vigilant leaders are able to navigate challenges and setbacks with a positive and resilient mindset, staying focused on their goals and finding creative solutions to overcome obstacles.

Overall, vigilant leaders are able to stay one step ahead of potential risks and challenges, ensuring that their organization is well-positioned for success in a rapidly changing world

2. A stock must have long term prospects.

A stock may have long-term prospects if the company behind it has a sustainable competitive advantage, a strong track record of financial performance, and a clear strategy for future growth and expansion.

Some key factors that can contribute to a company’s long-term prospects include:

Sustainable competitive advantage: A company with a unique product or service, proprietary technology, or a strong brand that gives it an edge over competitors is more likely to maintain its competitive position and generate sustainable growth over the long term.

Strong financial performance: A company with a history of strong revenue growth, profit margins, and cash flow is more likely to be able to invest in future growth opportunities and weather economic downturns.

Effective management: A company with a strong management team that is capable of executing its strategy and adapting to changing market conditions is more likely to be successful over the long term.

Innovation and adaptability: A company that is able to innovate and adapt to changing market trends and customer needs is more likely to stay ahead of the competition and maintain its growth trajectory over the long term.

Sound financial position: A company with a healthy balance sheet and manageable debt levels is more likely to be able to withstand economic shocks and invest in future growth opportunities.

3. A stock must be stable and understandable.

A stable and understandable stock is one that is easy to understand and has a relatively predictable performance over time. This type of stock is typically associated with companies that have a consistent track record of revenue growth, earnings, and cash flow, as well as a stable business model that is easy to understand.

Some key characteristics of a stable and understandable stock include:

Clear business model: A company with a clear and understandable business model is more likely to be perceived as stable and predictable by investors. This may include companies that operate in well-established industries, such as consumer goods or utilities, or those with a simple, easy-to-understand value proposition.

Consistent financial performance: A company that has a consistent track record of revenue growth, earnings, and cash flow is more likely to be seen as stable and predictable by investors. This may include companies that have a long history of profitability, or those that are able to generate steady cash flows from recurring revenue streams.

Low volatility: A stock with low volatility is less likely to experience sharp fluctuations in price, which can make it more appealing to investors who are looking for stable, predictable returns over the long term.

Strong fundamentals: A company with strong fundamentals, such as a healthy balance sheet, manageable debt levels, and a sustainable competitive advantage, is more likely to be seen as stable and predictable by investors.

4. A stock must be undervalued. For a stock to be undervalued it has to have an intrinsic value lower than the market price. The amount depends, but it is always good to have a margin of safety. The margin of safety is the amount by which an investor can purchase a security below its intrinsic value, and still have a reasonable expectation of earning a positive return on investment. It should be at least 15%-30% lower before you buy any stock, Buffet himself like it to be 50% before he does any action. Margin of safety is an important concept for value investors, who seek to buy stocks that are trading at a discount to their intrinsic value. By focusing on stocks with a high margin of safety, investors can minimize their risk of loss while maximizing their potential for gain, by identifying stocks with a low downside risk and a high upside potential. Remember that the most important trait of an succesfull investor is patience.

Step by step: how to invest in stocks

- First of all it is really useful to have an overview over your own analysis for different companies. This can for example be an excel sheet, where the coloumns represent different stocks, and the rows different criterias, for which you have analyzed the stock.

- To effectively find new potentially interesting stocks, a stock screener is very useful. With a stock screener, you can easily set criterias for your stock, for example country, PE ratio or return on investment. An example for a good stock screener is from the Financial Times.

- When you have found some interesting stocks, it is time to read their annual reports to see how their financial statements are doing, and also to learn about the companies leaders, visions and operations. To do this in a short and effecitve way, financial websites can be used, which collects the data for financial statements over different years and summarizes what the company is about. A good website to look at different stocks key-values is Yahoo-finance.

- After looking at the company, you should find the companys intrinsic value. Instead of tideously collecting data to calculate the intrinsic value, you can use one of the online calculators like the one from Gurufocus, where you just have to insert the ticker for your chosen stock.

- Now that you have collected data for your company, you should check the four pillars of a good stock as Warren Buffet likes to call it. If all the pillars are present and the fundamentals are looking strong, it is time to buy some stocks.

- The stock should be sold if the fundamentals of the company have changed and a bad trend is appearing. It can also be sold if the market price is way higher than it’s intrinsic value, but I like to hold them if the company is strong.