Litterature

Obtaining knowledge is the key factor when it comes to getting smarter. It is therefore important to use reliable resources and have good mentors.

Read, listen and observe

There are many ways to obtain knowledge, but it can only be done if your mind is open to new information

Digest the information

Think about what you learn and remember the key takeaways

Below are the best books on personal finance listed. They are personally ranked according to useful lessons on how to get rich. I have personally read each book several times, and I learn something new everytime I open them. They contain lifelessons from some of the most succesfull people in the world, and are packed with gold seeds of knowledge. Enjoy your reading, and remember to consume the valuable lessons by keeping your mind open and thinking about what you learn.

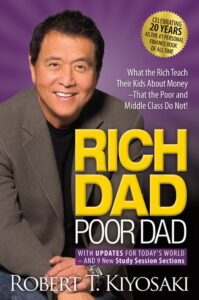

1. Rich dad poor dad by Robert T. Kiyosaki

“Rich Dad Poor Dad” is a personal finance book written by Robert Kiyosaki. The book is focused on the author’s two “dads,” his biological father (poor dad) and the father of his best friend (rich dad), and their differing financial philosophies.

Kiyosaki uses the contrasting teachings of his two dads to teach readers about the importance of financial literacy and developing the mindset of the rich. He advocates for building assets that generate passive income, such as real estate and stocks, rather than relying solely on earned income from a job.

The book also emphasizes the importance of taking risks and learning from failure, as well as the value of education that goes beyond traditional schooling. Ultimately, “Rich Dad Poor Dad” encourages readers to take control of their financial future by changing their attitudes and behaviors towards money.

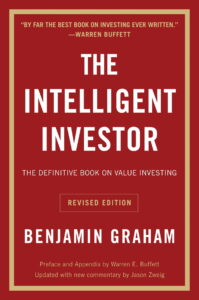

2. The intelligent investor by Benjamin Graham

“The Intelligent Investor” is a classic investment book written by Benjamin Graham. The book provides a comprehensive guide to investing and emphasizes the importance of a disciplined and rational approach to investing.

Graham introduces the concept of “value investing,” which involves seeking out stocks that are undervalued by the market based on their intrinsic value. He emphasizes the importance of analyzing a company’s financial statements and historical performance before investing in its stock.

The book also delves into the psychology of investing, highlighting common behavioral biases that can lead investors to make poor decisions. Graham advocates for a long-term approach to investing, focusing on the fundamentals of a company rather than short-term market fluctuations.

Throughout the book, Graham emphasizes the importance of risk management and diversification, encouraging investors to spread their investments across multiple stocks and asset classes. He also provides guidance on navigating different market conditions and understanding the role of inflation in investing.

Overall, “The Intelligent Investor” is a timeless guide to investing that emphasizes the importance of discipline, patience, and a rational approach to building a successful investment portfolio.

3. Think and grow rich by Napoleon Hill

“Think and Grow Rich” is a self-help book written by Napoleon Hill, focused on the principles of success and wealth creation. The book is based on interviews with successful individuals of the time and their common traits and strategies.

The book emphasizes the power of the mind and the importance of having a clear vision and a burning desire to achieve one’s goals. Hill also emphasizes the importance of persistence, taking action, and developing a positive mental attitude.

Hill introduces the concept of the “mastermind group,” which involves surrounding oneself with like-minded individuals who can offer support, guidance, and accountability in pursuing one’s goals. The book also explores the role of faith and the power of belief in achieving success.

Throughout the book, Hill emphasizes the importance of developing a specific plan of action and consistently working towards one’s goals. He also highlights the importance of learning from failures and setbacks, and using them as opportunities for growth and improvement.

Overall, “Think and Grow Rich” is a motivational and inspirational guide to achieving success and wealth through the power of the mind, positive thinking, and persistent action.

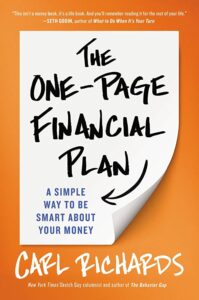

4. The one page financial plan by Carl Richards

“The One-Page Financial Plan” is a personal finance book written by Carl Richards. The book offers a straightforward and practical approach to financial planning, emphasizing the importance of simplicity and clarity.

Richards advocates for creating a one-page financial plan that outlines an individual’s financial goals, values, and priorities. He emphasizes the importance of aligning one’s financial plan with their personal values and avoiding the trap of chasing after money for its own sake.

The book also provides guidance on budgeting, saving, investing, and managing debt, offering practical tips and strategies for achieving financial stability and security. Richards emphasizes the importance of taking a long-term approach to investing and avoiding the temptation to chase after short-term gains.

Throughout the book, Richards emphasizes the importance of taking action and staying committed to one’s financial plan, while also recognizing the importance of flexibility and adaptability in the face of unexpected challenges or changes.

Overall, “The One-Page Financial Plan” is a practical and accessible guide to financial planning, offering readers a simple and actionable framework for achieving their financial goals and living a fulfilling life